In part one, we discussed Treasury Secretary Henry Paulson’s initial plan to bail out failing banks, former President Bill Clinton’s suggestion to place a moratorium on foreclosures until they can be manually reviewed, and finally, what foreclosure really means for banks and for the economy. Now, let’s watch the second half of Clinton’s interview:

| The Daily Show With Jon Stewart | Mon – Thurs 11p / 10c | |||

| Bill Clinton Pt. 2 | ||||

|

||||

This section of the interview is occupied with the upcoming election rather than the financial crisis at hand. Nonetheless, I’d like to focus on a couple of statements before we move on. Clinton pointed out that many voters will support the candidate with whom they most identify. Staunch supporters are not really the audience here, but rather those who are either not committed or not voting at all. He was so right when he said that those people will “love” Obama if they think he loves them. I could write a sermon here, but I’ll save it for Sunday. Suffice it to say that Clinton has successfully described what motivates most humans to love, including Christians (and it’s not necessarily a bad thing).

Around the 2:00 mark, Stewart pointed out that our nation is divided culturally, with the “left demonizing the right for being narrow-minded and the right demonizing the left for elitism.” I’m seeing a fair amount of this, to some degree or another, even among the religious blogging community. You’ve got Obama viewed as a socialist and a proponent of abortion from the right, and McCain viewed as a harbinger of totalitarianism and a warmonger from the left. My only point here is that Stewart is right: we are a severely divided nation, ideologically. Unfortunately, neither of these candidates is addressing the important issues when it comes to power structures in our nation and fiscal policy. All the left/right debate is serving as a supreme distraction from these essential problems.

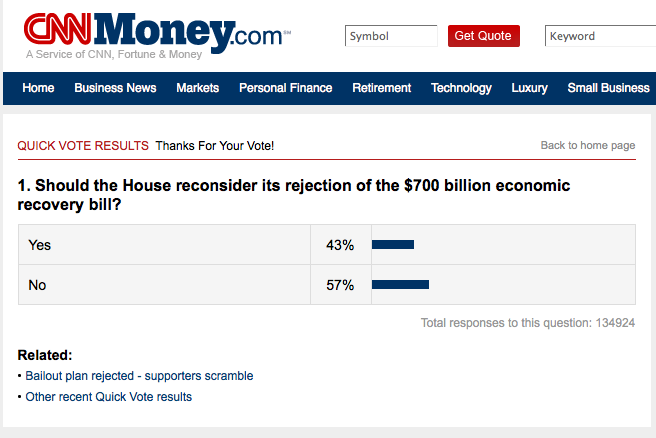

Last time, I promised we’d discuss how Congress is involved with the bailout situation. If you’ve been reading this blog recently, then you know that a bailout bill was negotiated between the Democrats and the Republicans and placed before the House of Representatives for a vote. It was expected, at least by President Bush, that this measure would pass. Amazingly, it ended up being blocked by a narrow margin. At this point a modified bill is being presented to the Senate for a vote today. At the moment, it seems the biggest change is to increase the FDIC insurance from $100K to $250K. I can’t seem to figure out what difference that makes in terms of the bill itself. I might be wrong, but do any of you have over $100K stored in a bank account somewhere that you’re really concerned about? I certainly don’t. No, friends, this is just smoke and mirrors — a sad attempt to divert attention from the American public’s massive opposition to this bill.

Just so we understand the role of Congress here, all they are doing is determining whether the U.S. Government will take financial responsibility for defaulted or risky debt in order to allow commercial banks to lend us more money. What Congress is unable to do, at the moment, is to keep the Federal Reserve from pumping more credit into the system on their own through pure inflation and international borrowing. Indeed, they have already done so to the tune of $630 billion and continue to do so on a regular basis. Let’s remember, the Federal Reserve IS NOT a branch of the U.S. Government, and they have no oversight whatsoever in terms of their own activities. The only reason Congress is voting is to determine whether these private banks that comprise the Federal Reserve will be on their own on this one, or whether Uncle Sam will underwrite the bill.

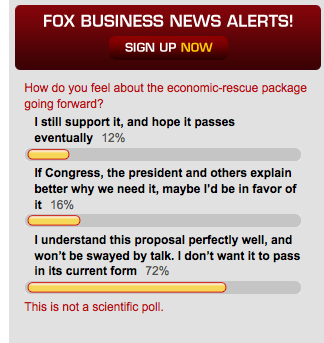

President Bush is convinced of the necessity for strong government intervention to “save” our ailing economy and the banks that are failing as a result. He was none too happy when the bailout bill failed in the House on Monday. It is my personal opinion that the Federal Reserve and those who benefit from it have fed him the notion that our economy will fail without this measure. They might even believe it themselves. Obviously, stock market investors do, because the NASDAQ dropped over 700 points in a single day as a result. That is the largest numerical drop (though not the largest percentage drop by a long shot). Even now, with the Senate poised to vote on a version of this bill today, informal polls are not indicating strong support by the public:

As you may have discerned by now, I disagree strongly that government intervention is necessary or wise in this case. Many intelligent friends (and others around the country) have been asking what we do in lieu of this bill, and how we can survive if something is not done. Most people recognize that there is a problem, but few know what we can do to ameliorate it. Even now, with the Senate poised to vote on a version of this bill today, informal polls are not indicating strong support by the public.

I am prepared to propose an alternative solution, and I plan to have it up later on today. Stay tuned, and as always, I’m looking forward to your comments and questions.